Section 179 Expense Election

You buy finance or lease qualifying equipment vehicles and or software and then take a full tax deduction on for this year.

Section 179 expense election. Pursuant to 179 c 1 a 179 election is made in the manner prescribed by regulations. 179 179 election. Both amounts will be indexed for inflation for tax years beginning after 2018. Any cost so treated shall be allowed as a deduction for the taxable year in which the section 179 property is placed in service.

Section 179 deduction changes with tax reform with tax reform the section 179 deduction allows taxpayers to write off certain tangible property costs for the tax year up to 1 million and increases the phase out threshold to 2 5 million. The cost over the income limit can be carried forward to 2015. The phase out limit increased from 2 million to 2 5 million. Section 1 179 5 c was promulgated in 2005.

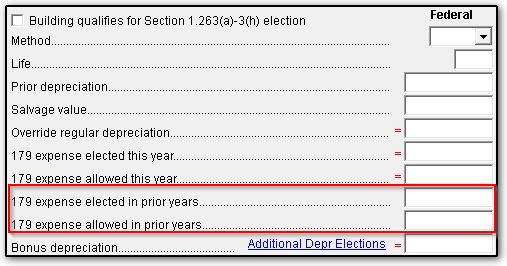

If net income is less than the cost of the qualifying property the section 179 deduction is limited to the income. Net losses disqualify a full section 179 election you cannot claim the section 179 deduction if you have an overall net loss for all actively conducted businesses in 2014. Section 1 179 5 c 1 of the income tax regulations provides the manner for making or revoking a 179 election for any taxable year beginning after 2002 and before 2008. Take the section 179 deduction by electing it which is done by filling out the required form and including it in your business tax return.

Section 179 allows taxpayers to deduct the cost of certain property as an expense when the property is placed in service. The form used to report information for a section 179 deduction is irs form 4562 which collects information on business property acquired and put into service. Section 179 details the maximum amount you can elect to deduct for most section 179 property you placed in service in tax years beginning in 2020 is 1 040 000 according to the internal revenue. Section 179 is simple.

To give you an estimate of how much money you can save here s a section 179 deduction calculator to make computing section 179 deductions simple. For tax years beginning after 2017 the tcja increased the maximum section 179 expense deduction from 500 000 to 1 million. A taxpayer may elect to treat the cost of any section 179 property as an expense which is not chargeable to capital account.